Frequently Asked Questions

Paycheck Questions

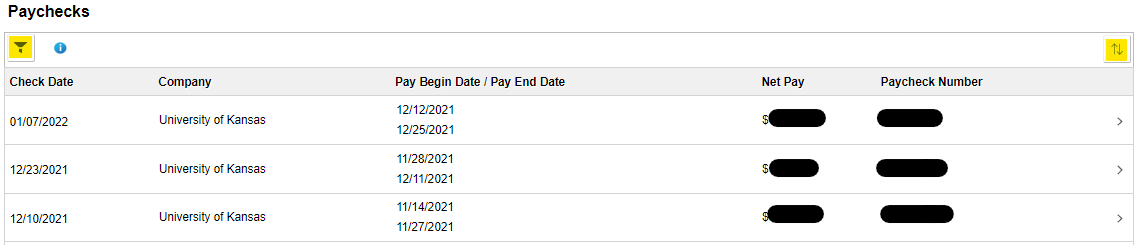

1. Log into your HR Pay account.

2. Click the Payroll Dashboard tile.

3. Click the Paychecks tile.

4. Click on the paycheck row for the paystub you wish to view.

- Paystubs open in a pop-up window.

- Current paystubs are typically available the Monday before payday.

- You can filter the results within a date range by clicking on the funnel on the top left of the list.

- You can sort the order of paychecks by clicking on the up and down arrows on the top right of the list and selecting the order choice.

If you are viewing your paystub to find your State of Kansas Employee ID:

The box with your employee information is next to the box with your name and address. Your KU Employee ID is listed first. Your State of Kansas ID is listed as SOKS ID and begins with a letter.

![]()

Inactive Employees:

Per the HR Pay Office, inactive employees will retain access in HR Pay for paychecks and personal data for up to 400 days past their separation date. This will allow access to paystubs or to update an address.

If you need assistance with accessing your HR Pay account, please call the IT Help Desk at 785-864-8080.

You can see your pay rate for each pay period on your paystub. If your pay rate is changing, it will not show on your paystub until the pay period in which the pay rate change is effective.

You can also see your compensation history online through your HR Pay account.

- Log into HR Pay.

- Click the Personal Details button.

- Click the Additional Information button.

- You will now see your name with a drop-down arrow at the top left corner of the screen.

- Click the drop-down arrow and select Compensation.

- Click View Compensation History.

If you have questions about your pay rate, please contact your department or Human Resources.

View the pay calendars from the home menu to determine the date of your paycheck with the corresponding pay period.

Typically you can view your paycheck stub on the Monday before the pay date.

New Employees

If you are a new employee, find the pay period that your start date falls within and locate the corresponding pay date. If you did not start at the beginning of a new pay period, your paycheck will be a partial check for the hours that you worked within that period. If you are in a salaried position, your pay will be prorated based on your start date within the pay period.

Common reasons pay is delayed:

- Time worked or leave time was not entered on the timesheet.

- Time was not approved by the supervisor on the timesheet.

- Direct deposit was not updated in a timely manner to be in effect for the next paycheck.

- Your appointment was not entered into the Human Resources system.

- We have not processed paychecks for the first pay period you began work.

- View the pay calendars from the home menu to determine the date of your paycheck with the corresponding pay period.

Contact the Payroll Office if you did not receive your paycheck.

A wage garnishment is a legal procedure through which the earnings of any individual are required to be withheld for payment of any debt. The State of Kanas is the official office of record for garnishments of KU employees. Garnishments come from different sources for different types of debt, such as bankruptcy or child support.

Garnishments are often ordered by the Kansas Department of Administration Setoff Program. The Kansas Setoff Program will apply State of Kansas payments or Kansas Income Tax refunds to debts owed to Kansas state agencies, Kansas district courts, Kansas municipalities (cities, counties, unified school districts, townships, fire districts, municipal courts, city or county hospitals, etc.), and/or State of Missouri Income Tax debts. You can visit the Kansas Setoff Program Debtor Web Inquiry website for more specific garnishment information.

If you are unsure of the garnishing agency, you can also contact the Payroll Office by phone or email.

There are multiple situations that can cause your benefits to be double deducted from your paycheck. Please contact the Staff Benefits office at 785-864-7402 to confirm your situation.

Yes, Human Resources offers an Academic Year Reserve Program.

Key Points:

- Enrollment is required each year, this is not an automatic renewal.

- Reserve deduction is only taken on full payroll periods during the academic year.

- Reserve deduction is a designated flat percentage of net pay.

- Electing this option will not impact any summer salary you might receive for administrative, teaching, or research work etc.

- Reserve funds are distributed by taking the deduction balance divided by the days in the summer multiplied by the summer days in the payroll period.

- Reserve distributions will be a separate check from any other summer pay.

- Reserve distributions will not have deductions or taxes taken. All involuntary and voluntary deductions and taxes were taken during the original payroll period (during the reserve deduction).

- Gross pay is not delayed. This process is a deduction that is taken during the academic year and then disbursed (refunded) during the summer periods.

- All deducted funds will be paid to you if you leave KU during the program period.

- This process does not impact any of the current interfaces or reporting for KU and State of Kansas systems, as pay is accounted for and distributed when it is earned. This is an employee deduction process only.

- Participation in this program does not impact your W-2, employment verification, or conditions of employment.

All employees have the option of establishing direct deposit to multiple accounts as a tool to help allocate salary for the months in which they aren’t paid. This is the responsibility of each individual employee to analyze their individual budget and determine what direct deposit allocation works best for them.

An example of this would be 25% into a savings account for the summer, and 75% into a checking account for current spending. Payroll can answer questions related to completing direct deposits, but we do not offer financial advising. Employees may work with their banking institution and financial advisors for individual unique circumstances.

The Kansas State Treasurer's Office may cancel checks not redeemed within one year of issuance. The amount is then considered unclaimed property.

A payee may still request payment (claim the property) by contacting the Kansas State Treasurer Unclaimed Property Division.

Direct Deposit Questions

You can update your direct deposit online or by appointment with the Payroll Office. See the Direct Deposit page for further instructions.

Key Notes:

- It is dependent upon the payroll cycle if your next paycheck will be deposited to the updated account. It is recommended to keep access to a previous account until you know if your next check will deposit to your new account. You may contact the Payroll Office by email, phone, or in-person to confirm.

- Updating your direct deposit in Enroll & Pay does not update it in HR/Pay and vice versa. These are separate systems that do not sync.

An employee's direct deposit remains in effect as long as the employee holds an active position. A direct deposit account is inactivated in the Payroll system after six months of leaving employment.

The State of Kansas has partnered with US Bank to offer a payroll paycard service for employees who do not have a bank account. Paychecks are automatically deposited to the paycard, which is used as a debit card. For more information on obtaining this paycard please contact Human Resources Appointment Staff at 785-864-5994.

- Update your direct deposit as soon as possible.

- Payroll recommends any updates be completed by payday Friday to be effective for the next paycheck.

- Contact Payroll to ensure any upcoming paychecks will not be deposited to that account.

Please contact the US Bank Focus Card customer service for issues specific to your paycard, such as access, closing account, etc.

If you have questions about the paycheck being deposited to your paycard, contact KU Payroll.

Tax Questions

Federal Withholdings

1. Log into your HR Pay account

a. Click the KU Payroll Dashboard button.

b. Click the W4 Tax Withholding button.

OR

2. Complete a W-4 form and submit it to the Payroll Office.

*You only need to complete one of the above to update your federal withholdings.

State Withholding

Online access to update state withholdings is not available.

1. Empoyees living/working in Kansas should complete the K-4 form and submit it to the Payroll Office.

2. Employees living/working in other states should view the Out of State Taxes page or contact Payroll.

There are different types of taxes deducted on your paycheck: FICA Tax, Federal Income Withholding Tax, State Income Withholding Tax.

FICA Taxes

The Federal Insurance Contributions Act (FICA) is the federal law that requires three separate taxes withheld from the employee's wages.

- 6.2% Social Security/OASDI Tax

- 1.45% Medicare Tax

- 0.9% Medicare Additional tax when the employee earns over a certain threshold.

Federal and State Income Withholding Tax

Employees are subject to federal income withholding tax and state income withholding tax. Each tax is withheld separately and based on income and the status given on the employee's federal W-4 and Kansas K-4 or other individual state income withholding tax form.

You can find the further calculation information on our Federal W-4 Form page and Kansas and Other State Taxes page.

The 2020 W-4 reflects changes resulting from the implementation of the Tax Cuts and Jobs Act of 2018. The new form uses the employee's income tax filing status, dependents, and other adjustments to determine the federal withholding liability.

FICA (Social Security and Medicare)

- You worked more than 30 hours in one or both weeks of the pay period.

- This is a combined total of all positions.

- The hours worked in each week must be 30 or less. It is not a combined total for the period.

- Example: You worked 35 hours in week 1 and 20 hours in week 2. You will be charged FICA since you worked over 30 hours in one of the weeks.

- You were not enrolled in the minimum number of credit hours for FICA exemption.

- Typically this is half-time enrollment.

- The maximum hours rule still applies over breaks.

You can find more information on the Student Exception to FICA Tax on the IRS website.

Withholding Tax

Every employee is subject to withholding tax based on the W-4 (federal) and K-4 or other state forms you submitted. These can be updated at any time.

You can change your tax withholdings for one paycheck. You will need to submit a W-4 and/or K-4 with the paycheck date for the new tax withholding status and another set of forms with the paycheck date to change your tax withholding status back. It is best to contact our office to ensure your forms are submitted in time for the paycheck calculation.

KU Payroll employees do not provide assistance or guidance on filing an income tax return as they are not tax experts.

There are 2 services that provide free tax preparation assistance on campus:

1. Legal Services for Students provides tax assistance for students and international employees for free. Visit the LSS tax information page for more information and tax filing workshop schedules.

2. Volunteer Income Tax Assistance Program provides free tax preparation services to those who qualify. Visit the VITA website for more information.

Miscellaneous Questions

Documents can be submitted to Payroll through:

- Secure email to payroll@ku.edu

- SAR/Payroll Dropbox

- Postal mail to:

- KU Payroll

- Carruth O'Leary

- 1246 West Campus Rd, Room 7

- Lawrence, KS 66045

- In Office

Secure Email

Encryption: KU departments, faculty, staff, and graduate research or teaching assistants are eligible. Visit the KU IT email encryption page for further assistance or contact KU IT Help Desk at 785-864-8080 or by email at ithelpdesk@ku.edu.

File Share from OneDrive: Both KU contacts and external contacts can securely share files through OneDrive for Business or Sharepoint Team Sites by granting permissions within OneDrive.

KU students, faculty, staff, and departments are eligible for a free download of Office 365 for home use through KU, which includes OneDrive for Business.

DropBox

If you simply need to give us documents, you may use the Student Accounts and Payroll dropbox. The dropbox is a depository located on the east side of Carruth O'Leary, built into the back of the building on the loading dock. The depository door needs to be pulled down until you see a space open. Drop the envelope in the space, and push the door up all the way to close.

- All documents must be labeled Payroll.

- It is best that documents are in an envelope, otherwise please staple, clip, or fold so they stay together in the dropbox.

- No more than 10 pages should be deposited to avoid obstructing the dropbox opening and chute.

Arrearage Payments placed in the dropbox:

If you are leaving an arrearage payment, it must be a check or money order. Your payment should be in an envelope marked for Payroll and include the employee's legal name and the purpose of the payment (such as arrearage payment), otherwise, your payment credit could be delayed. Cash is not accepted. Credit card payments can be made online through the KU Payroll Receivable portal.

Office Hours

KU Payroll is available for in-person services during office hours.

9:00am - 3:00pm, Mon - Fri

Please contact us by phone at 785-864-4385 or by email at payroll@ku.edu to schedule an appointment outside of these hours. Many processes do not require in-person services. Do I need an appointment?

- Log into your HR Pay account.

- Click the Personal Details tile.

- Click the Addresses tile.

- Click on the current address box to update it.

If you are unable to update your address through HR Pay, please contact the Human Resources Appointment Staff at 785-864-5994.

*Address updates in Enroll & Pay do not update your address with Human Resources.

The KU Medical Center (KUMC) has multiple employers within the center.

KUMC State of Kansas / University employees can call 913-588-5100 or email payroll-university@kumc.edu.

Health System / Hospital employees can call 913-945-5388 or email hospital_payroll@kumc.edu.

KUPI employees can call 913-588-2613.

If you are not sure who to contact, you can call the general KUMC number at 913-588-5000.

The University of Kansas uses The Work Number to provide automated verifications. View instructions on using The Work Number.

Inactive Employees:

Per the HR Pay Office, inactive employees will retain access in HR Pay for paychecks and personal data for up to 400 days past their separation date. This will allow access to paystubs or to update an address.

If you need assistance with accessing your HR Pay account, please call the IT Help Desk at 785-864-8080.

HR/Pay is used for employee information and processing.

Enroll & Pay is used for student information and processing.

These systems are separate and do not sync. HR/Pay does not have student academic information. Enroll & Pay does not have student employee information.

For instance, the direct deposit in HR/Pay is used for paychecks. Direct deposit in Enroll & Pay is used for refunds related to financial aid and student billing.