No Tax on Overtime

OB3 Overtime Tax Deduction FAQ

The OB3 was signed into law on July 4, 2025. The tax deduction is effective for calendar years 2025 - 2028.

The only qualified earnings are those associated with FLSA required overtime:

CTP: Comp Time Payout

OTP: Overtime Pay v 7.5

K13: Overtime for SP1 Students

The provision has no impact on employee paychecks as it does not immediately reduce federal withholding taxes. The deduction applies when an employee files their income tax return.

The University of Kansas is still required to withhold federal taxes (including FICA) on overtime wages.

No. The deduction includes the portion of overtime pay that exceeds the employee's regular pay rate. (the "half" portion of time and a half).

For example:

Jay Hawk earns $10.00 per hour. Overtime wages are paid at $15.00 per hour ($10 per hour x 1.5). If Jay works 1 hour of overtime, the qualifying deduction is $5.00.

The deduction is claimed when an employee files their income tax return and is available for both itemizing and non-itemizing taxpayers.

Comp time qualifies for the overtime deduction when paid out as a comp time payout.

Comp time earned and held in your leave balance does not qualify.

Comp time taken in lieu of other leave time does not qualify.

Holiday comp time is not eligible whether used or paid out.

Please see the Overtime Compensation Policy for more information on comp time.

Yes. The maximum deduction is $12,500 for single filers and $25,000 for joint filers.

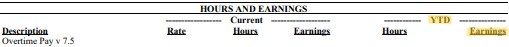

You can estimate your overtime deduction amount by reviewing your paystub in your HR/Pay account.

Under the "Hours and Earnings" section, look for the overtime pay description and find the YTD (year-to-date) columns. Multiply the YTD Earnings amount by 0.33333. The result is your estimated overtime deduction amount.

The applicable overtime descriptions are:

- Comp Time Payout

- Overtime for SP1 Students 1.5

- Overtime Pay v 7.5

The overtime deduction is on the W-2 in Box 14, with code OB3 OT.

No. FLSA exempt employees do not qualify for overtime, so the deduction does not apply.

Overtime pay is calculated at one and a half (1.5) times the hourly pay rate when a non-exempt (hourly) employee works over 40 hours in a work week.

View the Overtime Compensation Policy for more information.

Compensatory time is a balance of hours available for a regular, hourly (non-exempt) employee to use as paid time off, or in some cases, to be paid out. Comp time is accrued at one and a half times (1.5) the hours worked when the employee exceeds 40 hours worked within a work week (leave time does not count towards hours worked).

Holiday comp time is accrued at one and a half times (1.5) the hours worked over the holiday credit.

View the Overtime Compensation Policy for more information.

This applies to University of Kansas employees who are paid at an hourly rate and eligible for additional compensation when working over 40 hours in the work week, per Section 7 of the Fair Labors Standards Act (FLSA).